How sufficiency can replace the profit motive

The company Neue Holzforum from Bern, Switzerland, is manufacturing buildings with timber frames. Since its start in 1998, the owner has not aimed for a quantitative growth of his business. The number of houses produced each year is limited. He is focused on creating the optimal house by improving the quality while increasing the working conditions of his employees. As a result, customer satisfaction is high, reputation is high, the flow of orders is stable, financial and organizational risks are avoided. Self-limitation works. Self-limitation gives a sense of progress, prosperity, and wellbeing.

Making a profit is the ultimate test for any capitalist business, small or big. In a capitalist business model, all other motives, such as doing a business that you like, feeling a sense of accomplishment and pride, feeling progress and personal growth from your business, or serving your community all build on the profit-making foundation. They are secondary.

Since the profit motive is as old as capitalism, it has become deeply intertwined with how we understand the process of serving our material needs. We have to come to expect that human needs will be met through economic activity. Ultimately, the economy is supposed to be the process through which resources are allocated to satisfy human needs. But, is our current economic system doing this? Can we have a new kind of economy where the sufficiency and wellbeing motives have replaced the profit motive?

Profit means receiving more value from a business than the value you spend. Profit is almost always measured in money. It can include effort and all kinds for risks (political, social, or fiscal), but, even these extended meanings can usually be measured in money, for example how much money a corporation would lose in profit if the authorities decided to nationalize their assets (social), or increase corporate taxes (political).

What is the profit motive good for? First, to privatize risk. Every business, and all economic activity faces risk: bankruptcy, running out of resources, running out of credit. In capitalism, private businesses assume all these risks, with the exception that sometimes, if they are big enough, can be bailed out by the government. This is known as the too big to fail theory. But most businesses own these risks. It is their private risk. The profit motive forces businesses to stay focused on reducing these risks in order to keep their business running. We can argue that the profit motive forced the state to allow businesses to take private risks, and then reap all the benefits, if they are successful.

Second, profit enforces self-determination. Under capitalism, private business is confused and identified with free enterprise: the ability of entrepreneurs to start a business, and decide how to produce, and what to produce. The raw ideology of freedom used here basically says that individuals know best what kind of business the society needs from them. Making a profit enforces this ideology of self-determination, as if profit is the natural reward and consequence of this freedom.

Third, profit quantifies material progress. Countries use GDP as a marker of progress, and GDP is a measure of nothing but profit. When a nation has a growing GDP, that is understood as a sign of material progress. There is almost no distinction between profit and progress. But profit does not tell us anything about the wellbeing of citizens. Not only is profit a measure of progress, but profit itself, even though it’s just a number of money, carries a moral connotation. High profits are good. High profits are desirable. So when businesses make profit, we assume that means they are contributing to human progress.

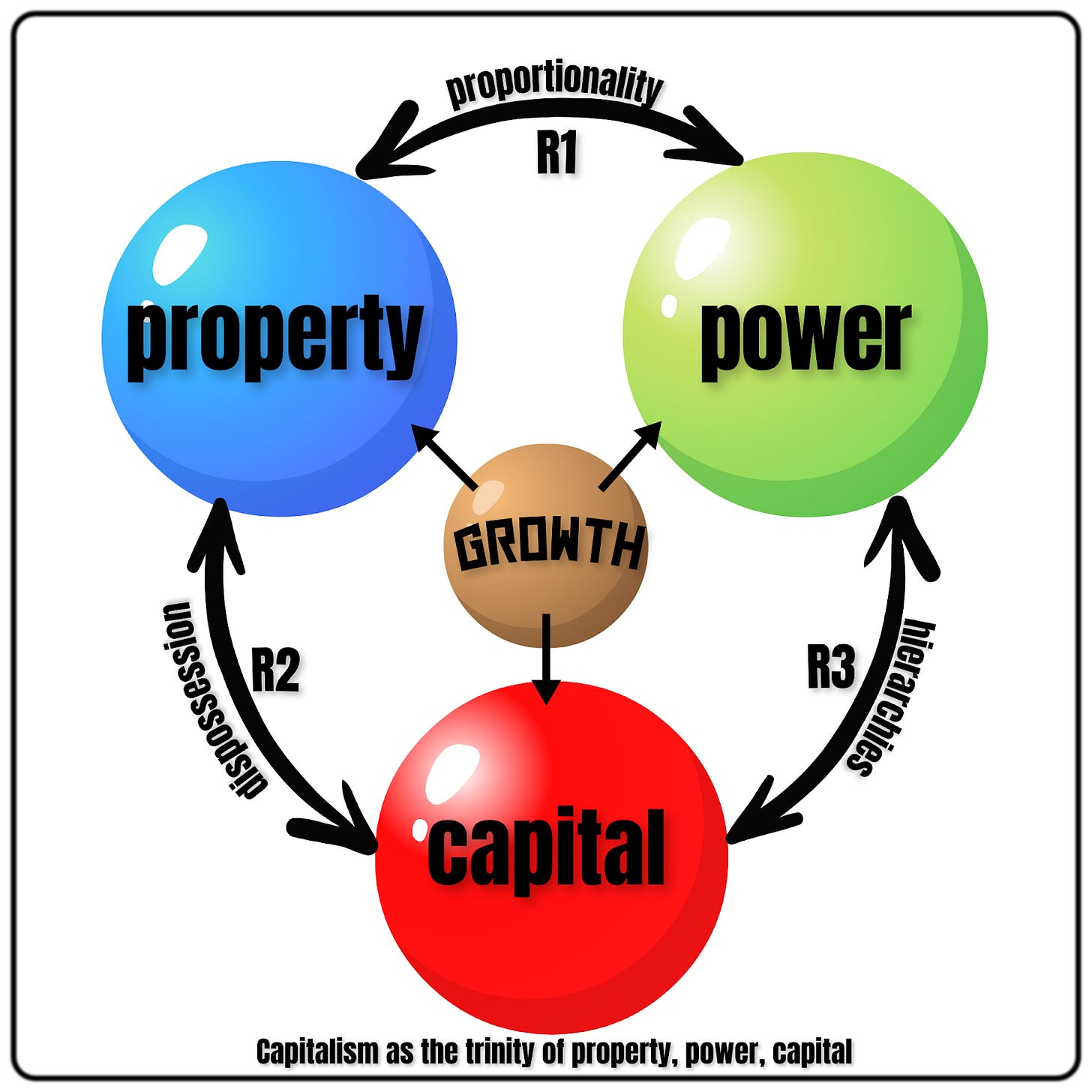

Fourth, profit stabilizes the trinity of capitalism, which is how the regimes of property, power, and capital, are linked through the doctrines of proportionality, hierarchies, and dispossession.Proportionality is about linking power to property, such as in how one share gives one vote in the ownership of corporations, dispossession is about removing property from its owner in order to transform it into profit-making capital, and hierarchies are the methods by which capital is managed in a top-down pyramid-like structure (think corporate organisation charts, for example). In this sense we can argue the profit motive evolved together with these doctrines in a feedback loop, sometimes being the cause of the doctrines, sometimes being the effect of the doctrines.

In this way, the quest for unlimited profit makes capitalism to keep growing indefinitely on a finite planet. Eventually, this bubble will burst.

To answer the question how sufficiency can replace the profit motive, we can look both at theory and some examples of real businesses. There is a whole book about this.

Sufficiency in business, like the model used by Neue Holzforum, is about producing just enough to cover human needs. Sufficiency is about eliminating unnecessary products and services, eliminating manipulation through marketing, and giving up the quest for profit for its own sake. Sufficiency is a mentality of enough, but that kind of enough that maintains the wellbeing of people. Sufficiency is both about freedom away from consumerism, and a voluntary acceptance of a moderate material lifestyle that does not suck resources away from humans in poorer regions. In essence, sufficiency is about serving the needs of humans, while profit is about serving the design of capitalism.

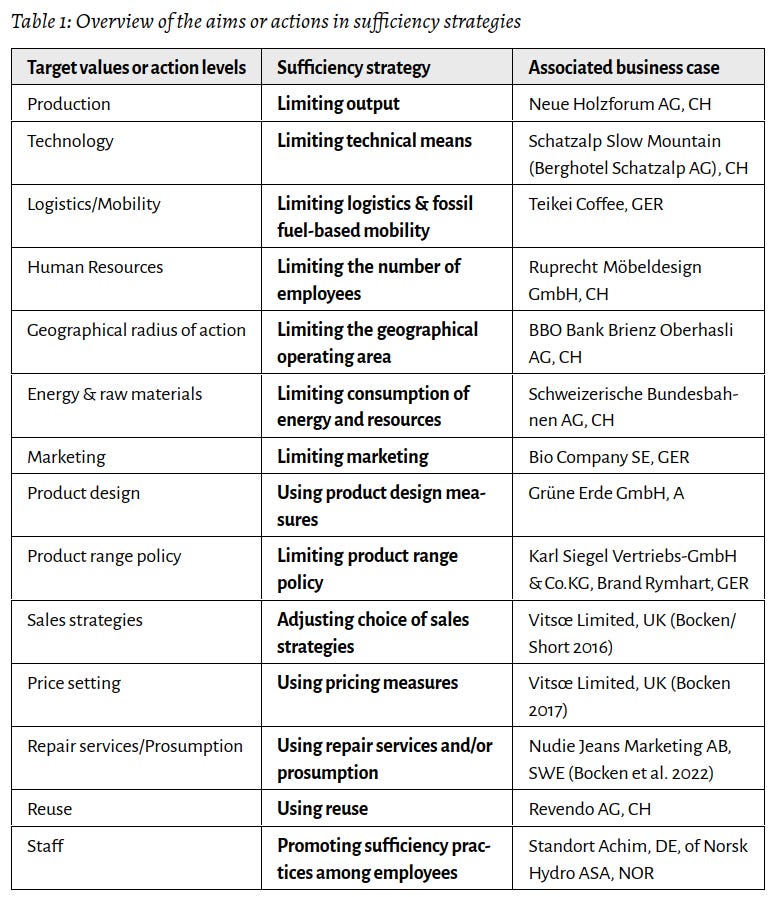

Here are some examples of businesses that use sufficiency strategies:

( Sufficiency in Business, Maike Gossen, Laura Niessen, eds., 2024, page 52-53)

The bottom-up approach may not always work, but it’s still better than the alternative. Orienting businesses around sufficiency is much closer to serving the needs of humans. However, if the political and social climates are not supporting sufficiency-based business, then it may be difficult to operate such a business. Risks are lowest when they are socialized, for example when companies develop strong relationships with their customers and the community where they operate. The profit-motive is damaging, but sufficiency-based business models work and they will serve us better.